If you’ve not been feeling yourself recently due to money problems, you’re not alone and there are many individuals struggling whilst trying to navigate their way out back into the black.

And although financial difficulty is felt across many households, the emotional strain of accumulating debt can have profound implications for an individual’s psychological well-being.

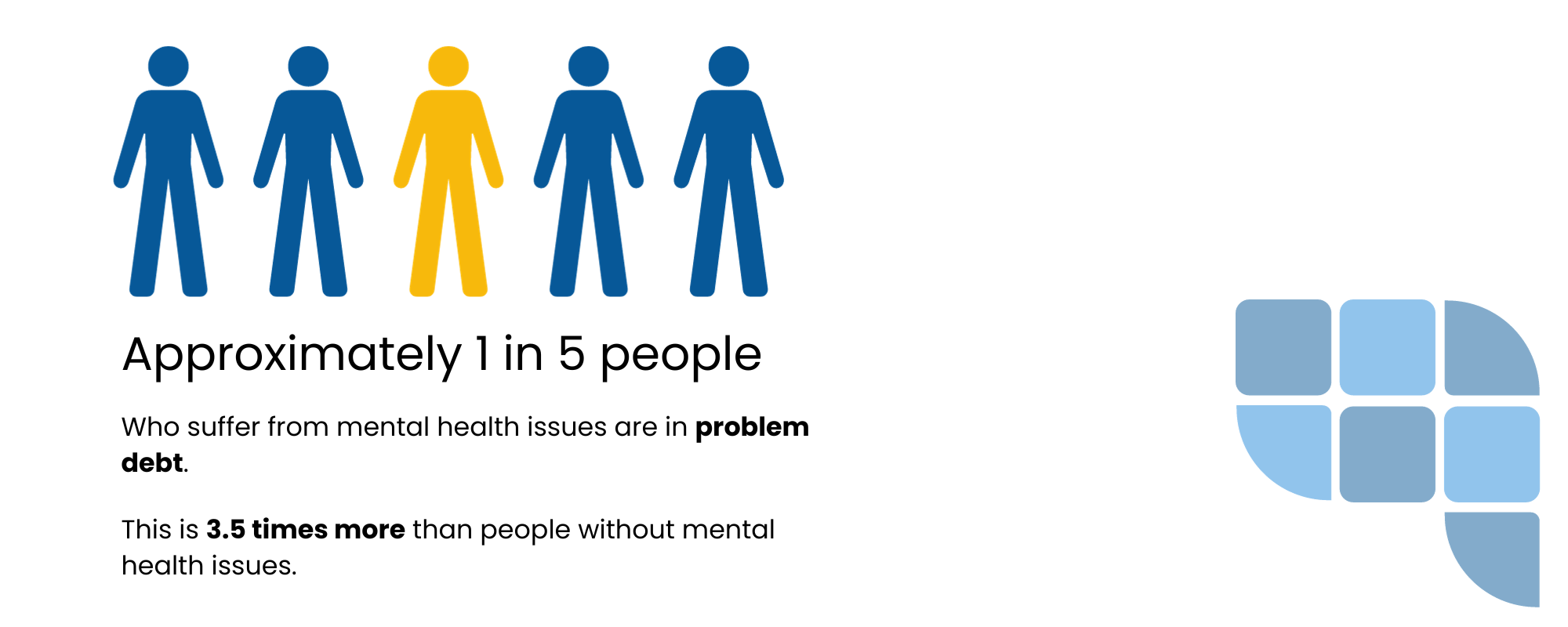

The relationship between debt and mental health is complex and can rear it’s head in many ways. In a recent study it was discovered that 46% of people experiencing financial difficulties are also suffering from mental health problems.

In this article we discuss;

The common emotional and mental health difficulties money problems can cause

How to manage mental health problems that arise with debt

Where you can seek help and advice from mental health professionals

The Psychological Effects of Debt

The psychological effects of debt can cause severely heightened negative feelings that can have a huge impact on your mental health.

Debt and Mental Health are heavily intertwined, and both can negatively effect the other in many ways.

Shame and Embarrassment

In many societies, financial success is equated with personal worth.

As a result especially when seen as a consequence of poor financial decisions, debt can lead to intense feelings of shame and embarrassment.

These feelings can be exacerbated by the stigma that surrounds debt, making it a topic many avoid discussing openly. Quite often, this can leave you with a sense of isolation that compounds feelings of guilt and worthlessness.

Such emotions can lead to individuals avoiding social interactions, further isolating you from potential support systems.

What’s more, these feelings might prevent individuals from seeking essential financial guidance, which can only worsen the situation.

Anxiety and Depression

Debt’s shadow is long and often casts itself across an individual’s mental landscape. Anxiety and depression are amongst the most common mental health issues our customers experience.

The constant worry over repayments, company phone calls and potential debt collection, can understandably lead to heightened anxiety.

When confronted with a seemingly insurmountable debt and no obvious way out, feelings of despondency and low self esteem can emerge.

This relentless cycle of debt anxiety and desolation can push many into clinical depression.

In fact, research shows actually revealed that people who are having financial difficulties are 4 times more likely to experience longer term depression than those without financial problems.

Helplessness

When suffering with problem debt, the future can appear bleak.

The despair, combined with relentless reminders of money owed, can foster feelings of helplessness. For many, this perceived loss of control is the hardest to bear.

You feel trapped, unable to see a clear path forward through the immediate financial issues.

This can be debilitating and almost bring you to a complete standstill. The negative sentiment can cripple decision-making abilities, preventing you from making any constructive steps to address your personal debt.

Stress

Financial difficulty can trigger the body’s stress responses, negatively impacting your mental and physical health.

Chronic activation of this “fight or flight” system can result in physical symptoms. This can range from minor irritations such as migraines and digestive issues, to sleep disturbances or a weakened immune system.

If you experienced over a prolonged period of time, this constant state of stress can contribute to more severe health issues like hypertension and heart diseases.

Moreover, the stress can interfere with your ability to focus, making it harder to find solutions or seek assistance.

Relationship Strains

Financial difficulties don’t just strain bank accounts; they strain relationships.

Money disputes are amongst the top reasons couples argue, leading to mistrust, resentment, and relationship breakdowns. Recent research shows that approximately 1 in 5 people have experienced a relationship breakdown due to financial difficulty.

When under financial strain, emotional resources are drained, making it harder to engage in constructive conversations.

This often results in arguments, blame games and further eroding trust.

Want to find out more about how PennyPlan can help you with your debt?

Managing Mental Health Problems Related to Financial Challenges

When in the fire of financial stress and experiencing mental health issues, it is vital you take some sort of positive steps, no matter how small towards tackling the negative effects.

We understand it is easier said than done, and that it is hard to think clear when actually in that situation.

That is why below we have laid out some of the key tips our well-being team recommend to get back on the road to positive mental and financial health.

Open Communication

Facing debt can be a solitary journey, and often the last thing you wish to do is let someone else in and discuss the situation.

However, open communication can serve as a huge relief and weight off your shoulders.

By talking with trusted individuals whether family or friends, you can gain perspective, receive advice, and most importantly, feel less alone.

Sharing your fears and frustrations can also alleviate the burden, transforming it from a solitary struggle into a shared challenge to navigate out of.

One key advantage that people find is that someone who is not under the same stress can often provide fresh ideas and approaches to how to tackle the issue.

Remember the saying, ‘a problem shared is a problem halved’.

Setting Realistic Goals

When looking at your debt as whole, tackling the issue and overcoming can feel insurmountable.

However, by breaking it down into smaller, achievable goals you can transform the journey and achieve your end goals.

Instead of viewing it as a mountain, look at it from the perspective of a series of manageable hills.

By setting smaller, short-term targets and celebrating each accomplishment, the process becomes less daunting, and your morale gets much-needed positive boosts along the way.

Stay Informed

Information is one of your most important weapons against battling fear and uncertainty.

Often, the trepidation surrounding debt is magnified by a lack of understanding.

By arming yourself with as much knowledge about your financial situation, rights, and potential solutions, the dark shadow of debt becomes less intimidating.

This includes understanding the intricacies of your unsecured debt, interest rates you are paying, and terms of repayment.

Events such as the end of an interest free period on your credit card debt can not just significantly increase your minimum repayment, but also halt your speed of reducing the debt total.

Also, being aware of your rights when facing entities such collection agencies or legal action such as enforcement agents, can help manage the stress situations like this take on your mental health.

Our insights page provides you with a wealth of information and knowledge. It offers resources and to help you understand your financial situation better, making the journey through debt more navigable.

Healthy Lifestyle Choices

Your physical well-being has a direct correlation with mental health condition.

While financial worries loom, it’s vital not to neglect your body.

To maintain a positive lifestyle amongst the midst of financial problems, there a three key components.

Regular Exercise – Regular exercise has been proven to reduce stress, anxiety, and symptoms of depression.

Healthy Diet – A balanced diet can ensure that your body and brain receive the essential nutrients it needs for good function. This can help in decision-making and mood regulation, which are both required on your journey to debt freedom.

Sleep – Often the first casualty of stress, sleep is vital component for cognitive functions and emotional balance.

Prioritising these three pillars of health can provide the strength required to face financial stress head-on.

Mindfulness and Meditation

In the barrage of collection calls and payment reminders, finding a moment of quiet reflection can seem impossible.

However, it’s in these moments of silence that clarity often emerges.

Mindfulness practices and meditation have long been recognised for their benefits in managing anxiety and stress.

By focusing on the present moment and finding things that you are grateful for can help provide a short respite from the overwhelming fears about the future or regrets about the past.

Techniques like deep breathing, guided meditation, and progressive muscle relaxation can anchor an individual, providing a safe harbour in the stormy seas of debt-induced anxiety.

Want to find out more about how PennyPlan can help you with your debt?

Seeking Professional Support For Mental Health Issues

Sometimes a mental health problem can be too much to cope with on your own. It’s understandable, and everyones situation is different.

The same can be said for mental health illness too.

This is why sometimes it is imperative that if your mental health plummeting, that you should seek extra support.

Professional support can be accessed in many way, and there are many benefits to seeking assistance to mental health.

Objective Perspective

Sometimes, the power of the emotional effects felt during financial stress can obscure clarity.

In these moments an external, unbiased perspective can be invaluable.

This is where professional therapists can help. Professional therapists can help provide an objective viewpoint that can only be seen ‘outside of the box’.

Well-being professionals use clinical psychology techniques that may give you different angle to attack the issue.

They aren’t there to judge or chastise, but to listen and guide.

Through therapy, individuals can unravel the tangled web of emotions surrounding their debt, identifying triggers for anxiety and depression and develop strategies to confront and manage these feelings.

Tailored Coping Strategies

Each person’s relationship with debt and the emotions it provokes are unique to you.

A strategy that helps someone else’s mental health problem might not work for yourself.

Therapists are trained to recognise these nuances and devise coping mechanisms tailored to your individual needs.

Whether it’s through cognitive behavioural therapy techniques, which focus on changing negative thought patterns, or through more holistic approaches like art or music therapy, these coping strategies can be instrumental in managing debt stress.

A Safe Space

At its core, therapy offers a sanctuary and a safe haven for you to air issues impacting your mental health.

It’s a place where your fears, regrets, and anxieties can be openly discussed without fear of judgment or retribution.

This act of verbalising concerns for the first time, can often feel awkward and intimidating.

However, knowing that these discussions are confidential allows for more open and honest communication.

Access to Resources and Medication

Sometimes, a mental health illness can go beyond what can be managed with therapy alone.

In severe cases, individuals may need medication to manage symptoms and improve their overall quality of life.

A mental health professional can evaluate the need for medication and refer you to a psychiatrist or primary care doctor for a prescription.

By seeking the professional support of therapists, areas of concern be identified quickly ensuring its impact can be minimised.

Want to find out more about how PennyPlan can help you with your debt?

Seeking Professional Debt Solutions

Like mental health problems, sometimes financial difficulty may need require outside advice and support to get back on track.

Professional debt advice can be sought in various ways, offering different kinds of support.

Debt support can vary from receiving advice for you to action, to debt solutions companies who will advise and take care of the solutions for you.

Seeking professional advice to improve your financial health can have many benefits.

Expertise and Experience

Professionals in the debt relief industry bring a wealth of knowledge that may not be readily available, or potentially hard to decipher.

These financial experts are trained to understand the intricacies of various financial scenarios and can recognise patterns that may be easy to overlook.

With years of experience, they’ve likely encountered numerous cases similar to yours and can therefore provide guidance and in-depth information that can help tailor the best solution for you.

Navigating the world of debt without this expertise can be daunting and potentially costly.

This is because some debt solutions like an Individual Voluntary Arrangement cannot be set up by anyone. They require licensed professionals such as an Insolvency Practitioner who are authorised to administer these powerful debt solutions.

Relying on debt professionals can ensure you make well-informed decisions, saving both time and money in the long run.

Peace of Mind

The roller-coaster emotional effects of debt can be overwhelming.

Being chased for credit card payments and instalments for personal loans can cause psychological distress that makes it difficult to give attention to anything else.

Seeking professional debt advice offers not just actual assistance, but its secondary impact is that it also provides emotional relief.

Knowing that there’s a structured plan in place put in place by experts, can significantly reduce stress levels.

In turn, this peace of mind can benefit other areas of your life, from your mental health to even improved relationships.

The assurance that professional debt support provides, let you know you’re not alone in this battle and that there’s a clear, structured path to debt freedom.

Avoiding Legal Action

Unmanaged debt isn’t just a financial concern, it can lead to severe legal action such as bailiffs and court action.

Creditors and debt collection agencies have the right to take legal action if debts remain unpaid.

This can range to events such enforcement action or attachment of earnings. The stress of potential legal action can be even more daunting than the debt itself.

By seeking professional debt help early on you can minimise these risks, and with some debt solutions even halt the action altogether.

In addtion, most debt companies can provide solutions where they liaise with creditors on your behalf, taking away the anxiety of having to discuss your plight with the companies you owe money to.

PennyPlan Debt Solutions – Free Mental Wellbeing Sessions with Our Services

We acknowledge that financial struggles can deeply impact mental health.

Recognising the connection between the two, we’re proud to say we are the first debt solutions company in the UK to offer mental well-being services as part of our offering.

The free mental well-being sessions with a qualified in-house psychotherapist. These sessions can be instrumental understanding the underlying issues that are preventing you getting your financial health back on track.

Our first of its kind service is raising awareness of the importance of treating both the cause (financial debt) and the symptom (mental distress) simultaneously.

Our well-being team can offer strategies to cope with anxiety, depression, and any ongoing mental illness that could be accompanying your financial struggles.

Furthermore, they provide a safe space to voice concerns, discuss feelings, and seek emotional relief.

It’s a holistic approach that ensures that while your financial health is being restored, your mental health receives equal attention.

This dual approach not only aids recovery but ensures a more sustainable, long-term solution.

By addressing the psychological impacts of debt, individuals are better equipped to make sound financial decisions, manage stress, and stay on the path to financial independence.

It’s a testament to our commitment to not just provide financial solutions, but to genuinely care for the overall well-being of our clients.

Psychological Effects Of Debt – Conclusion

Debt and mental health will be forever intertwined, and the emotional and psychological toll of debt cannot be underestimated.

It’s a burden that can infiltrate every aspect of one’s life, from personal relationships to physical health.

Understanding the profound link between financial strain and mental well-being is the first step towards addressing both issues.

Remember, seeking help is not a sign of weakness but of strength.

Whether it’s reaching out to a trusted confidant or seeking professional assistance, every step taken is a step closer to regaining control over your mental and financial health.

If you or someone you know is struggling with mental health issues related to debt, don’t hesitate to seek professional help.

The road to recovery, both financially and mentally, is not one that has to be walked alone.

With the right support, the journey can be more bearable and ultimately lead to a brighter future.

Want to find out more about how PennyPlan can help you with your debt?