The number of financial scams for consumers to steer clear of was already extensive, but this figure skyrocketed with the mainstream adoption of digital currency, commonly known as cryptocurrency.

In recent years, the world has witnessed a significant surge in the popularity of cryptocurrencies.

While these digital assets offer exciting opportunities for investment and financial growth, they have also given rise to a darker side – the alarming increase in crypto scams.

The world of cryptocurrencies produces some wild stories from someone buying 2 pizzas for 10,000 Bitcoin which at the time back in 2010 was worth around $40 (now worth an eye watering $377 Million USD or £300 Million Pounds) to Dogecoin, a crypto currency created based around a viral internet meme of a dog ‘Shiba Inu’ which went on to have a value of over $2 Billion USD.

The confusing nature of the virtual currency and the high volume of money pumped into the crypto world daily, produces the perfect climate for scammers who promise investment schemes that will be essentially the modern day equivalent of printing free money.

The age old saying will always ring true and it is no different in the world of crypto assets, ‘if it sounds to good to be true, it probably is’.

The Confusing World of Cryptocurrency

The world of cryptocurrency as a beginner can be a bewildering experience, akin to stepping into a complex and rapidly evolving digital realm. The sheer diversity of cryptocurrencies, each with its unique features and purposes, can be overwhelming.

Deciphering the intricacies of wallets, cryptocurrency payments, transaction fees all while trying to understand an unfamiliar exchange to buying cryptocurrency is enough to confuse anyone.

If this isn’t enough you then have the added worries of keeping your digital assets safe. Should you keep your funds in a digital wallet? Where should you keep your new picture of a ‘Bored Ape’? What is a non-fungible token anyway?

Understanding the underlying technology, blockchain, and the intricate terminology associated with this space adds an additional layer of complexity. The volatility of cryptocurrency prices and the constant emergence of new projects contribute to the confusion for newcomers.

The Crypto Scam Landscape

Cryptocurrencies, with their decentralised nature and relative anonymity, have become a breeding ground for various fraudulent schemes.

From Ponzi schemes to fake initial coin offerings (ICOs), unsuspecting investors are falling victim to sophisticated scams that promise quick and lucrative returns.

In simple terms, ‘decentralised’ means that there is no single central authority or control point, this means it is almost impossible to implement regulatory measures and security protocols.

While offering privacy and security benefits to legitimate users, unfortunately also provides fertile ground for the proliferation of crypto scams.

The anonymity associated with crypto transactions provides scammers with a veil to operate behind, making it challenging for authorities to identify and apprehend them.

As crypto scam victims grapple with the financial fallout of crypto scams, they often find themselves burdened with significant debts.

The stress and anxiety associated with financial difficulties can take a toll on mental health, leading to depression, sleep disturbances, and other psychological challenges.

The Stats Behind the Scams

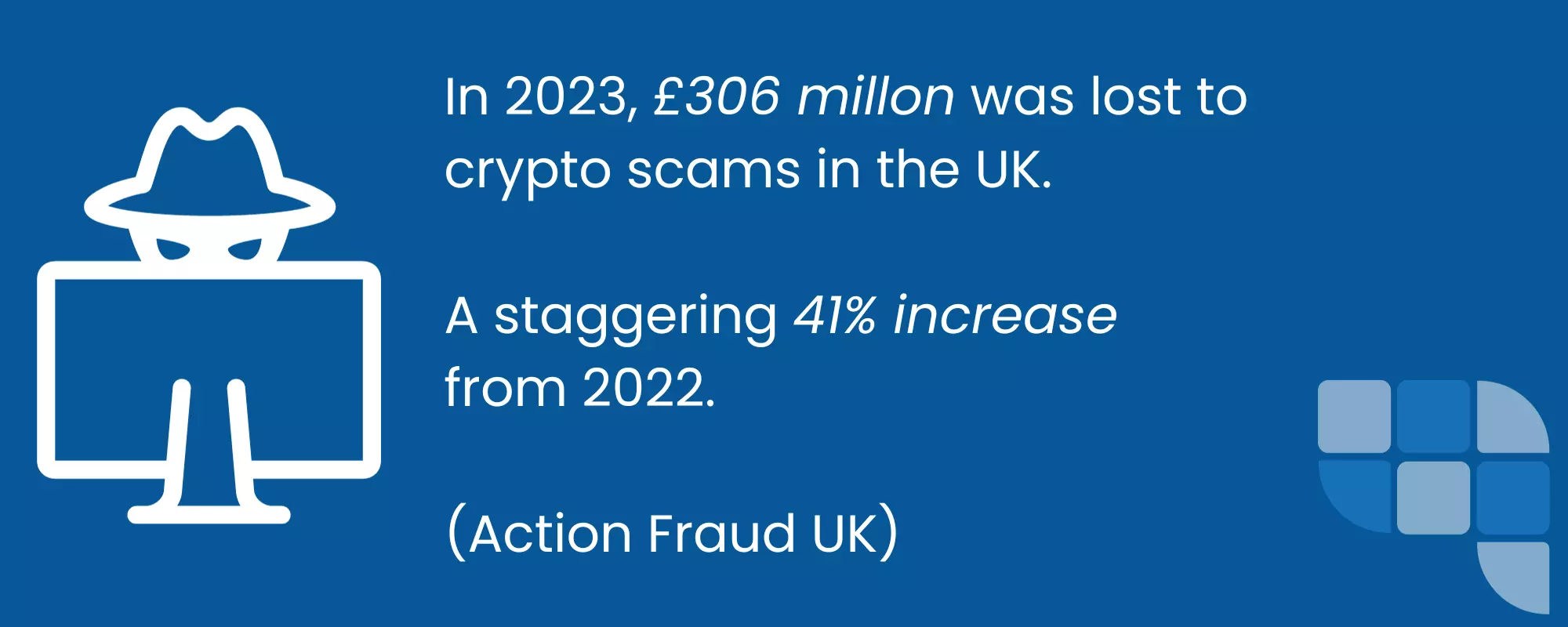

The rise in crypto scams have resulted in some eye watering figures.

Action Fraud published stats showing in the last 12 months (year ending March 2023) a total of over £306 Million has been lost by the UK public alone to scammers.

This is an increase of over 41% on the 2022 numbers and shows a worrying trajectory.

The concern is that the actual figure is likely much larger, with the likelihood that a large percentage more will also go unreported.

This 41% increase only accounts for those who voluntarily shared such information with authorities, suggesting that the actual impact of crypto scams could be even more significant.

A study by consumer advice site Which? at the end of 2022 found that 20% of people who had fallen victim to a scam in the last 2 years were tricked into sending money to criminals using cryptocurrency.

To understand the wider scale of scams we only have to take a look at the stats posted by the federal trade commission in the US.

Between January 2021 and June 2022 there was a staggering $1 Billion lost in payments made by crypto currency by more than 46,000 people who fell victim to scams and were advised to send money using crypto coins.

Common Cryptocurrency Scams

The world of crypto is almost alien to a lot of the general public and crypto scammers are well aware of this, often preying on those who see the opportunity to get rich quick and maybe aren’t as well versed in the due diligence that should be taken to avoid being a victim of a cryptocurrency investment scam.

Common cryptocurrency scams range from attempts to catch out the unsuspecting public with basic phishing scam emails to highly elaborate schemes which involve the scammer playing the ‘long game’.

This might involve a team of scammers who act as so called ‘investment managers’ who will then help the unsuspecting client by showing them where to invest money and how to gain access to more funds quickly by taking credit from numerous sources so they do not miss out on a ‘once in a lifetime opportunity’.

Phishing Scams

Phishing scams have been a popular way amongst scammers to access personal information and use this for their personal gain.

Cryptocurrency phishing scams are no different.

They involve tricking individuals into revealing their private keys or login credentials through deceptive emails, websites, or messages.

Scammers often create fake websites or emails that mimic legitimate cryptocurrency platforms, leading unsuspecting users to disclose sensitive information.

Pump and Dump Schemes

In pump and dump schemes or rug pull scams, fraudsters artificially inflate the value of a low-cap cryptocurrency by spreading misleading information and creating a buying frenzy.

Once the price has surged, they quickly sell off their holdings, causing the value to plummet and leaving other investors with significant losses.

Fake Initial Coin Offering (ICOs)

Scammers capitalise on the popularity of initial coin offerings, where new cryptocurrencies are introduced to the market. They create fake ICOs, promising high returns to investors.

After upfront payment, the scammers disappear, leaving investors with worthless tokens.

Impersonation Scams

Impersonation scams involve creating fake social media accounts, fake apps or a fake website that mimic influential figures or well-known cryptocurrency projects.

Scammers use these platforms to deceive people into sending cryptocurrency or providing private information.

Fake Wallets and Exchanges

Fraudulent digital wallet and exchange scams involve creating a fake crypto wallet or trading platforms.

Unsuspecting users are tricked into depositing funds, only to realise that the platform is a scam, and their investments are lost.

Mining Scams

Mining scams trick individuals into investing in fake mining operations or cloud mining services that promise significant returns.

In reality, these operations often lack the necessary infrastructure, and investors end up losing their money.

Cryptojacking

Cryptojacking involves hackers gaining unauthorised access to individuals’ computers or devices to mine cryptocurrencies without their knowledge.

This depletes the victim’s computing resources and may lead to increased electricity costs.

Exit Scams

In exit scams, founders of a cryptocurrency project disappear with the funds raised from investors, often after the project gains significant traction.

This type of scam undermines trust in the crypto space and can have widespread financial implications for those who invested in the project.

How to Spot Cryptocurrency Scams

Spotting a crypto scam requires vigilance and a critical eye, as scammers often employ sophisticated tactics to deceive individuals.

Here are some tips to help you identify potential cryptocurrency scams:

Too Good to Be True

Be wary of offers that seem too good to be true, such as guaranteed high returns with little or no risk. Scammers often use the promise of quick and substantial profits to lure in victims.

If someone is coming to you offering free money there is normally a reason why.

Unsolicited Communication

Be cautious of unsolicited emails, messages, or a social media message or posts promoting investment opportunities and claiming to have insider access.

Legitimate projects typically don’t aggressively reach out to strangers, crypto scammers do.

Lack of Information

A lack of clear and comprehensive information about a project, team, or technology is normally an obvious red flag.

Verify the legitimacy of a project by researching its whitepaper, team members, and overall reputation.

Pressure to Act Quickly

Scammers create a sense of urgency, pressuring individuals to make quick decisions without proper research.

Take your time to thoroughly investigate any investment opportunity.

Fake Websites and URLs

Verify the legitimacy of websites by checking for secure connections (https://), ensuring the URL is spelled correctly, and looking for signs of a professional design.

Scammers often create fake websites to imitate legitimate platforms.

No Clear Use Case or Technology

Legitimate cryptocurrencies and blockchain projects have a clear use case and explain their technology in a comprehensible manner.

If a project lacks transparency about its purpose and technology, it may be a red flag.

Anonymous Teams

Be cautious if the project’s team members are anonymous or have limited information available online.

Legitimate projects typically have a transparent and well-documented team.

Fake Wallets and Exchanges

Only use reputable wallets and exchanges. Scammers may create fake wallets or exchanges to trick users into depositing funds. Double-check URLs and download apps from official sources.

Check Reviews and Feedback

Look for reviews and feedback from other users.

If a project is legitimate it will normally have a lot of reviews and feedback from others.

If it doesn’t, it definitely needs more research before committing.

Educate Yourself

Stay informed and continuously educate yourself about the cryptocurrency space.

Awareness is a powerful tool in avoiding falling victim to the many scammers who are out to make quick money.

The Role of Insolvency Practices – Picking Up the Pieces

Chris Lenehan, Director of Operations & Wellbeing at PennyPlan, an UK based Insolvency Practice.

He has spoken about the shocking increase in clients needing their help as a result of crypto currency scams and the debts they are left with in the aftermath.

“Insolvency practitioners like PennyPlan play a crucial role in helping individuals when it comes to picking up the pieces after a cryptocurrency scam.

It is becoming more and more common for some to fall victim to these cryptocurrency scams and be left with a large amount of debt.

We look to help them by dealing with the unaffordable debt they have been left with, finding a solution that is affordable for their circumstances.

We also offer access to our in-house wellbeing & psychotherapy team to deal with any underlying trauma that the client might have as a result of what has happened”

The Importance of Mental Health Support

Recognising the impact of financial distress on mental health, insolvency practices should adopt a holistic approach.

Not only do they need to deal with the debt but they also need to understand if there are any underlying issues which might have contributed to this situation happening in the first place.

Understandably when speaking to someone who has lost been involved in money scams, this is a time where people will have heightened emotions as they have invested money in good faith not expecting someone to steal money from them.

Collaborating with mental health professionals or providing resources for counselling can enhance the overall well-being of clients dealing with the aftermath of crypto scams.

By addressing both financial and mental health aspects, insolvency practitioners can offer comprehensive support to individuals on their journey to recovery.

The Rise of the Cryptocurrency Scam – Summary

As we move into a world where crypto is more prevalent heading into 2024, it becomes even more important for everyone to become more aware of common crypto scams and understand how to what protection you have in place, if any, before you send cryptocurrency.

The rise of crypto scams has brought about unprecedented challenges for individuals facing financial turmoil and mental health struggles.

While there can be many benefits associated with having a crypto account and investing money into what a lot of people regard as ‘currencies of the future’, it is imperative to be aware of the pitfalls of potential investment scams.