In today’s fast-paced world, the ties between financial well-being and mental health have never been more evident.

Across the UK, countless individuals grapple with the stress from debt. From increases in mortgage interest rates, to increased credit card debt repayments and council tax.

But beyond these financial figures lies a deeper, often unspoken reality: the profound emotional toll of debt.

Debt is more than just a monetary burden. It carries with it feelings of anxiety, shame, and fear about what lies ahead.

And this stress isn’t limited to our bank accounts. It spills over into our personal life affecting areas such as our sleep, relationships and even self worth.

This creates a relentless cycle. A poor financial situation causes declining mental health, and vice versa.

However, understanding this intertwined relationship between money and mental well-being offers hope.

True financial freedom goes beyond clearing debts; it means achieving a mental space where financial concerns don’t overshadow every thought and emotion.

Our aim is to arm you with practical financial strategies while also guiding you towards mental resilience.

By addressing both the tangible and intangible aspects of this issue, we hope to pave the way for a more balanced future for you.

Understanding the Debt-Stress Relationship

In the world of personal money matters, debt is usually just seen as numbers. Whether it’s the amount you owe, the interest percentages, or repayments.

Yet, there’s a deeper narrative that often goes unspoken. The deep psychological and emotional impact the stress from debt can inflict.

It isn’t just about monetary values. It’s rooted in our fears, aspirations, societal expectations, and personal experiences.

As we explore further, we’ll dissect how debt can affect our psyche and why our emotional responses to financial struggles are just as crucial as the monetary figures themselves.

Want to find out more about how PennyPlan can help you with your debt?

The Psychological Impact of Debt

For many, dealing with debt is not just a financial term. It’s a dark cloud over you that can cause declining mental health.

The financial stress of debt, coupled with the ever-mounting interest of credit card bills and the juggling of repayments, can lead to a heightened state of anxiety.

Over time, this persistent anxiety can snowball into clinical conditions such as depression.

For some, the constant reminders of unpaid bills and the threat of legal or bailiff action can evoke feelings of despair and hopelessness. This often leading to sleep disturbances, irritability, and even physical ailments like migraines.

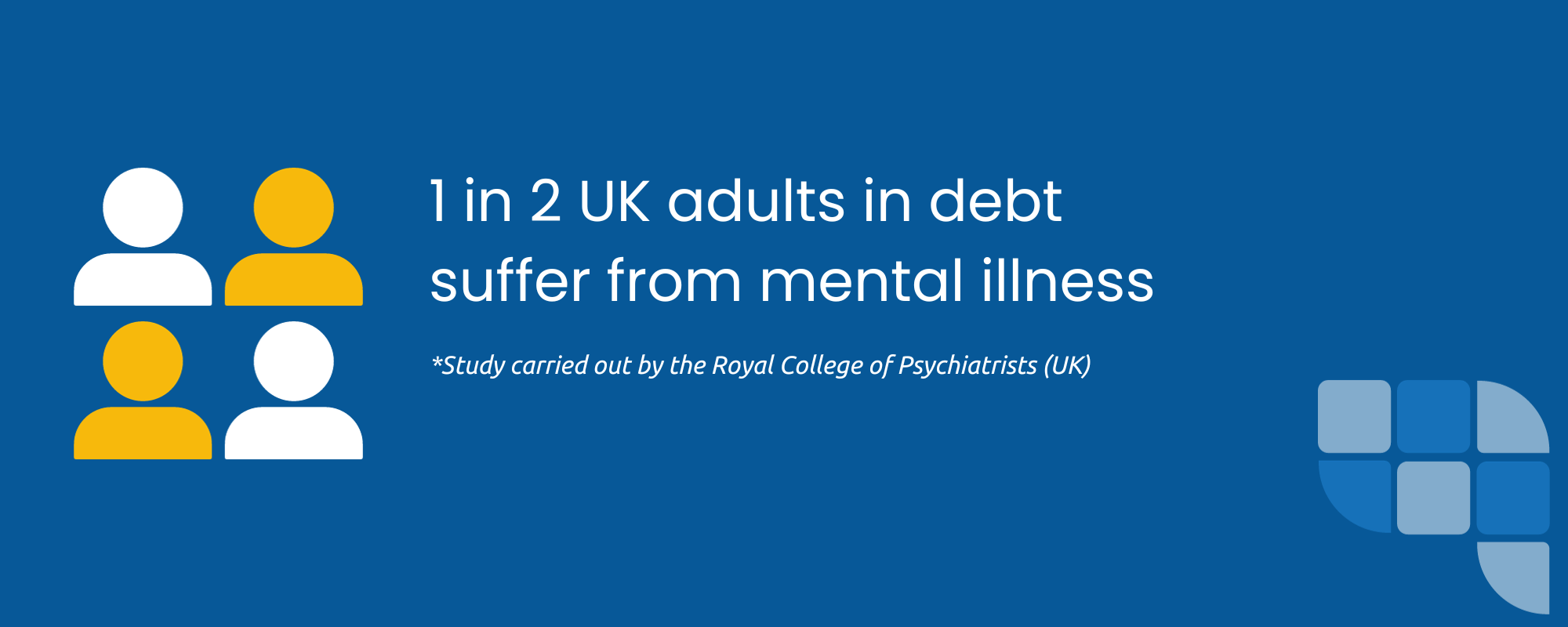

In a recent study conducted by the Royal College of Psychiatrists (UK), found that 1 in 2 UK adults in debt also reported mental health problems.

Why Financial Problems Aren’t Just About Money

At the heart of financial struggles usually lies a deeper issue, which often gets overshadowed by the easier to understand figures of debt.

It’s the shame of not being able to provide, the guilt of past financial mistakes, and the abyss of hopelessness thinking it might never get better.

Money in most societies is often tied to one’s worth, which can lead to monumental pressure on individuals.

Financial difficulties therefore can be seen as a personal failure, even if they result from unforeseen circumstances like job loss or a relationship breakdown.

And in the age of social media, the pressures to keep up with others can become heavy.

The neighbour’s new car or your friend’s lavish holiday can unintentionally serve as constant reminders of your own financial burden, deepening the negative feelings and lead to low self esteem.

And because of the stigmas associated with debt, . Many hide their financial struggles, fearing judgment or criticism.

This secrecy further compounds mental health issues, leading to a sense of isolation and a lack of emotional support.

Debts are not just about a credit card debt or loans, they’re about the emotional baggage they carry.

The weight of societal pressure, personal aspirations, and the fear of not being ‘good enough’.

Understanding these feelings and how to minimise their impact is crucial in gaining a foothold of your financial situation.

Financial Management Tips to Alleviate Debt Stress

While the emotional toll of debt and mental health are undeniable, effective financial management can offer a beacon of hope and a positive path forward.

By approaching your financial stress with a clear strategy and proactive measures, you can not only address the challenges ahead but also alleviate the accompanying psychological stress.

In the forthcoming sections, we’ll discuss the importance of;

Creating a budget you can live within

Prioritising debts and payments

Setting up an fund for emergencies

The value of seeking expert advice

These strategies serve as pillars of success, providing stability amongst the clouds financial stress can put in front of you such as debt anxiety, ensuring you’re equipped for the challenge ahead.

Creating a Realistic Budget

One of the fundamental steps towards good financial health is creating and adhering to a realistic budget.

A well-structured budget serves as a financial compass, guiding our expenditures and helping ensure our money is allocated efficiently.

The importance of budgeting cannot be understated. It offers clarity, reduces the risk of unexpected financial shortfalls, and gives us greater control over our finances.

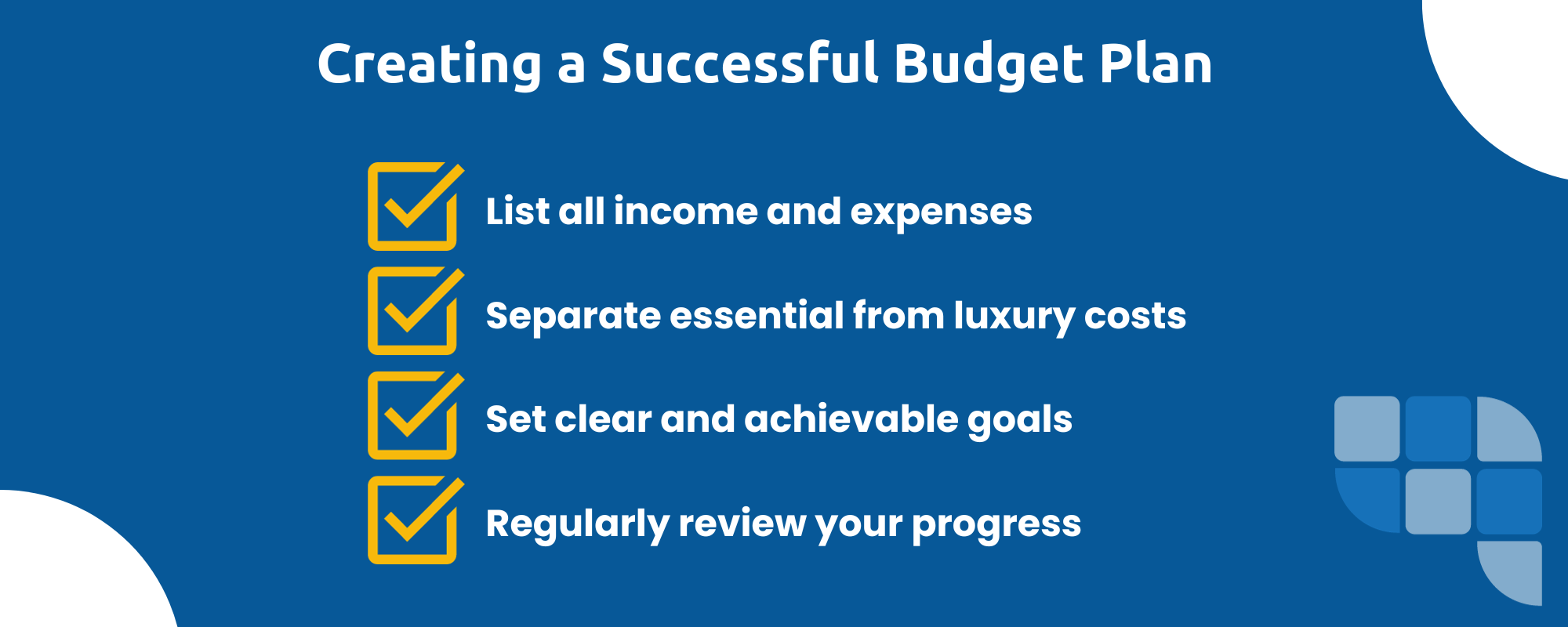

To craft a successful budget:

Begin with a thorough assessment of your income and expenditures. Write down all sources of income and list every expense, no matter how trivial it might seem.

Distinguish between needs and wants. Prioritise essential costs such as rent, utility bills, and groceries over desired spending such as holidays or a night on the town.

Set clear financial goals. Whether it’s paying off a particular debt or saving for a significant purchase, having clear and achievable goals can motivate you to stick to budgeting.

Regularly review and adjust. Financial situations can change, and the budget should be flexible enough to allow unforeseen expenses to be covered.

Prioritising Debt Repayment

With debts accumulating from various sources, it can be hard to know where to begin.

Prioritising debt repayments is essential in ensuring the most pressing financial obligations are met promptly.

A commonly advised strategy is to tackle high-interest debts first.

These debts, if left unchecked, can balloon over time, making them even harder to pay off.

Two popular debt repayment methods on your own are:

-

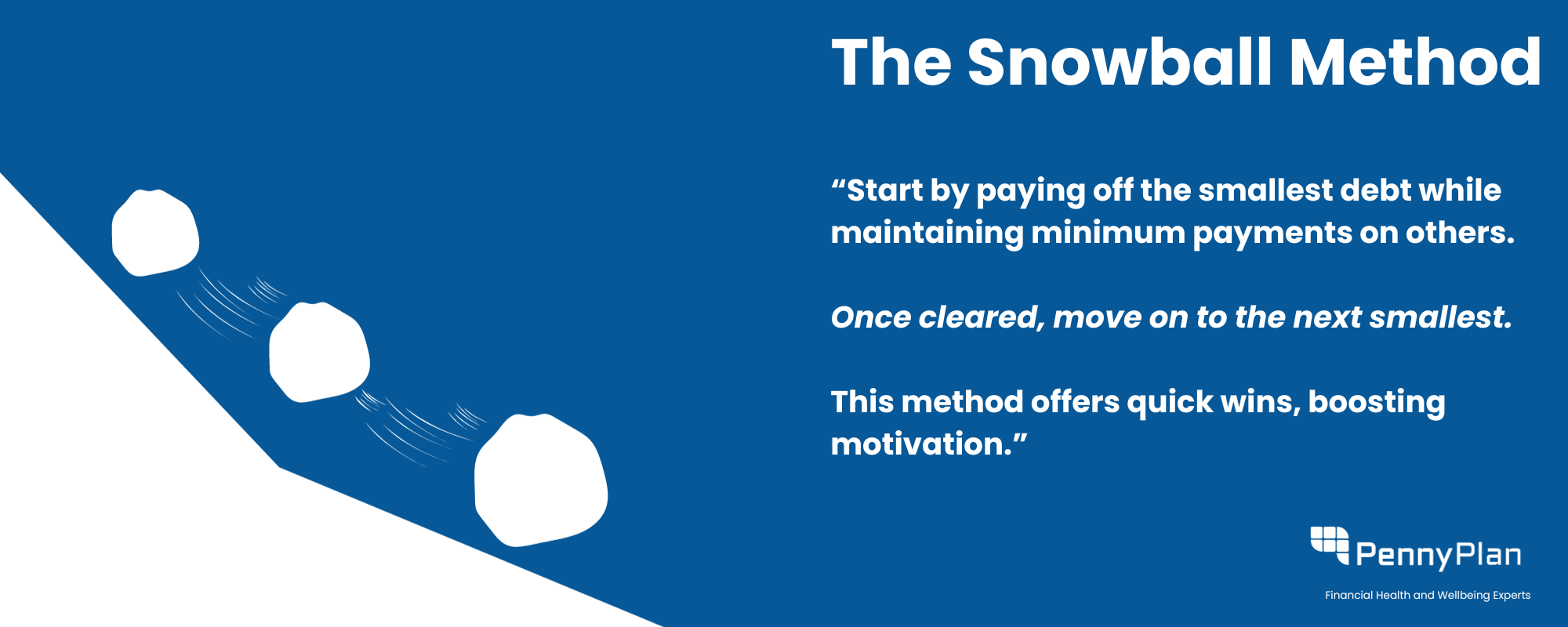

Snowball method: Start by paying off the smallest debt while maintaining minimum payments on others. Once cleared, move on to the next smallest. This method offers quick wins, boosting motivation.

-

Avalanche method: Focus on the debt with the highest interest rate first, regardless of its size. This can save more money over the long run.

However, resolving the debt problem on your isn’t the best option for everyone. If you find this could be a challenge for you, it is always best to seek professional debt advice.

Debt solution advisors can provide clarity to help you deal with debt, informing you of your options and offering tailored strategies for your circumstances.

Building an Emergency Fund

Life is filled with unpredictability, and you can rest assured financial surprises will happen when you least want them to..

An emergency pot can act as a safety net, providing a buffer against unexpected expenses like medical emergencies or car repairs.

This fund can give peace of mind, knowing that a financial setback won’t send you spiralling into deeper debt.

Starting an emergency fund can be as simple as setting aside a small amount from each payday.

Even if resources are limited, saving even a modest sum consistently can accumulate to surprising amounts over time.

To grow this fund:

-

Open a separate savings account to avoid temptations of spending.

-

Automate transfers from your main account, ensuring regular contributions.

-

Cut non-essential expenses temporarily to boost your fund faster.

-

Enrol in round-up schemes with your bank that put money aside from each transaction.

Ultimately this side pot helps you to manage money through setbacks, ensuring that when life throws a curveball you’re financially prepared.

Want to find out more about how PennyPlan can help you with your debt?

Mental Wellness Practices for Better Financial Health

Our thoughts, emotions, and mental resilience play a pivotal role in how we manage our finances.

In addition, financial pressures can significantly influence our psychological well-being. Therefore, it makes sense to address both elements at the same time.

Adopting specific mental wellness practices can not only improve our mental state but also boost our approach to financial challenges, creating a more structured path to overall well-being.

Mindfulness and Meditation

In the chaos of money problems and the debt collectors contacting you, the power of mindfulness and meditation can provide a welcomed beacon of calm.

These practices offer a way to distance yourself from your immediate stresses and gain a clearer mindset.

By being present and engaged with the current moment, mindfulness allows you to approach money issues without being overwhelmed by them.

There are several benefits of mindfulness when using it to battle financial stress.

For one, it helps reduce debt anxiety which understandably accompanies money worries.

Regular mindfulness practices can lead to a decrease in the body’s stress responses, making daunting financial worries feel more manageable.

Additionally, by promoting awareness of one’s thoughts and emotions, it becomes easier to make balanced financial decisions rather than impulsive ones driven by stress or fear.

To integrate mindfulness into your routine:

Start with a daily 5-minute meditation. Focus on your breath, and when your mind wanders to financial concerns, gently bring it back to the present moment.

Practise grounding exercises during moments of financial uncertainty. One method involves identifying five things you can see, four you can touch, three you can hear, two you can smell, and one you can taste.

Recognising and Challenging Negative Thought Patterns

Our thoughts have a huge influence on our actions.

Negative beliefs about money, often coming from past experiences can be debilitating.

Thoughts like “I’m terrible with money” or “I’ll always be in debt” can normalise the behaviour if left unchallenged.

To navigate the maze of such negative thought patterns:

-

Maintain a thought diary. Jot down any negative thoughts about finances as they arise.

-

Challenge these thoughts. For every negative belief, ask yourself: Is this fact or assumption? What evidence challenges this thought?

-

Replace negative thoughts with positive affirmations. Instead of “I can’t manage my money”, try “I am learning to handle my finances better every day”.

This cognitive restructuring process can shift your perspective, replacing hopelessness with enthusiasm and proactivity.

Seeking Professional Support

It’s essential to remember that seeking help is not a sign of weakness but actually one of strength.

Financial stress if unaddressed, can take a toll on your mental health. Therapy services can provide a safe space to express concerns, gain new coping strategies, and build resilience to the challenges ahead.

Therapists do this by offering techniques to manage stress, address any underlying issues related to money (like past traumas), and help in setting realistic goals for a better financial future.

For those who do not feel comfortable with one-on-one therapy, other options are available.

Support groups can provide a sense of community, where shared experiences can be both comforting and informative.

Helplines which are available round-the-clock, can be lifelines in moments of severe distress.

Remember that reaching out is a step towards healing, both financially and emotionally.

Want to find out more about how PennyPlan can help you with your debt?

The PennyPlan IVA – Resolving Debt and Mental Health Woes

Money worries often go hand-in-hand with mental distress. Nowadays with more awareness, it’s becoming increasingly evident that tackling only one element of this vicious cycle is not enough.

If you have ever explored what debt solutions can help resolve your issues, you may may have found options that can help provide respite from your debts.

However these debt solutions neglect the underlying issues or trauma, and the psychological strains that come with carrying debt.

This is why PennyPlan IVAs offer a first of its kind approach to managing debt.

Our IVA (Individual Voluntary Arrangement) plans provide a holistic solution, to step in to bridge the gap between debt and mental health.

The common IVA is a structured method to help individuals manage their debts, ensuring creditors are paid in a manner that’s sustainable for the debtor.

However, our approach goes far beyond this basic service.

Recognising the powerful link between monetary problems and mental health challenges, our IVA plans incorporate support systems to aid the mental well-being of our clients.

By offering free psychotherapy sessions, we’re not just addressing the debt on paper but the anxiety, stress, and other mental health issues that frequently accompany it.

It’s a recognition of the fact that financial health and mental health are inextricably linked, and we believe solutions must cater to both to be truly effective.

In doing so, we aim to empower our clients with not only the tools to navigate their debts but also the mental resilience to face future financial challenges with confidence and clarity.

This holistic approach sets a new standard, one that understands and respects the diverse nature of debt challenges in today’s world.

Integrating Mental Health Support in Debt Solutions

Historically, debt solutions have been largely transactional in nature, focusing on numbers, balances, and repayment plans.

However the nature of debt is deeply personal, and often carrying with it a baggage of emotions, anxieties, and stress.

Recognising this, our one of a kind IVA plans incorporate psychotherapy represents a profound shift in addressing the root causes and not just the symptoms of money problems.

IVA plans that integrate mental health support essentially acknowledge a simple truth: Financial difficulties aren’t just about numbers, they’re also about the people behind those numbers.

These enhanced plans provide a dual pathway to recovery.

On one hand, they offer structured repayment plans that make debt management more achievable and less daunting. On the other, the inclusion of psychotherapy sessions offers individuals a safe space to address the psychological burdens that often accompany financial hardships.

So, what are the benefits of such an integrated approach?

-

Holistic Healing: Traditional debt solutions might alleviate financial stress temporarily, but they can leave underlying emotional traumas unaddressed. An IVA plan with psychotherapy ensures that both financial and emotional recovery happen in tandem.

-

Enhanced Commitment: When you feel mentally supported, it makes it easier to stay committed to your repayment plans, reducing the risk of further financial struggles.

-

Building Resilience: Therapy sessions can equip you with coping strategies, helping to build resilience against the financial challenges ahead.

-

Long-term well-being: By prioritising both mental and financial health, our IVA plans set the foundation for long-term well-being. They ensure that once your debts are cleared, you’re mentally equipped to move forward with a positive outlook.

Integrating mental health support into debt solutions like our IVA plans is not just innovative, it’s essential.It sets the bar to a more compassionate, understanding approach to debt management.One that puts you at its heart.

Want to find out more about how PennyPlan can help you with your debt and mental wellbeing?

Conclusion

Navigating the stormy waters of debt is not just a financial journey but an emotional one as well.

The complexities of debt stretch beyond numbers, but are deeply embedding in the fabric of our mental well-being. The road to financial freedom isn’t merely paved with pounds and pence but with resilience, understanding, and support.

With this, it is essential for every debtor to recognise the duality of this challenge.

Prioritising mental health does not distract you from addressing financial issues.

Instead, it provides the clarity and emotional strength required to face these challenges head-on.

Just as you cannot ignore a growing debt, it’s equally vital not to neglect the stress, anxiety, or emotional distress that often accompany it.

These intertwined parts of our lives feed into one another, and addressing one without the other can result in a cycle of recurring problems.

Furthermore, seeking support in these challenging times isn’t a sign of weakness, it’s a hallmark of wisdom.

There’s strength in acknowledging when help is needed, whether that assistance comes in the form of debt counselling, therapy services, or both.

Holistic solutions, like our IVA plans stand as testament to the evolving understanding of this intertwined relationship. Such initiatives underscore the importance of addressing the person behind the debt, not just the debt itself.

In closing, as we tread the path to financial stability, let’s not forget the invaluable asset we carry with us: our mental well-being.

By seeking the right support, challenging stigmas, and giving equal attention to both our financial and mental health, we can create a future that’s not just debt-free but also rich in good mental health.

Learn More About Our IVA and Wellbeing package

Debt is more than a financial challenge. It’s a personal journey, and you don’t have to walk it alone.

We invite you to explore our innovative IVA plans. They’re tailored not just to provide debt relief, but to uplift your mental well-being too.

With our integrated psychotherapy sessions, we provide a holistic approach that ensures you work towards financial freedom, while also fostering emotional strength and resilience.

Remember, every successful journey begins with a single step.

Whether you’re looking for actionable financial strategies or seeking a safe space to share and process your experiences, we’re here to stand by you.

Want to find out more about how PennyPlan can help you with your debt and wellbeing?